Charles River Tailored Portfolio Solutions

The demand for customized portfolios in wealth management is accelerating. Investors increasingly expect managers to tailor portfolios according to their personal circumstances and beliefs. For wealth managers and advisors, offering customized portfolios is becoming an important differentiator. Historically, managers have struggled to offer this capability due to cost, operational challenges, or technology constraints. Recent trends such as the evolution to low or zero trading fees and newer technology capabilities that facilitate customization at scale have enabled firms to offer personalized portfolios more broadly.

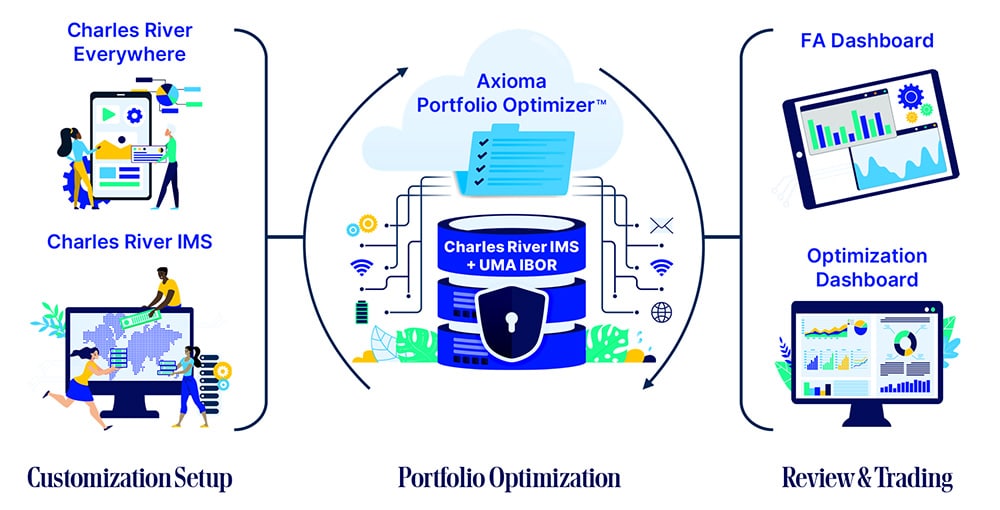

Powered by Qontigo’s industry leading Axioma Portfolio Optimizer engine, Charles River’s Tailored Portfolio Solutions platform enables wealth and asset management firms to offer high-value portfolio customization at scale. Firms can manage the construction and trading of in-house models, third party separately managed account (SMA) strategies, or operate Direct Index programs tailored to the requirements of each individual investor.

Charles River Tailored Portfolio Solutions

The demand for customized portfolios in wealth management is accelerating. Investors increasingly expect managers to tailor portfolios according to their personal circumstances and beliefs. For wealth managers and advisors, offering customized portfolios is becoming an important differentiator. Historically, managers have struggled to offer this capability due to cost, operational challenges, or technology constraints. Recent trends such as the evolution to low or zero trading fees and newer technology capabilities that facilitate customization at scale have enabled firms to offer personalized portfolios more broadly.

Powered by Qontigo’s industry leading Axioma Portfolio Optimizer engine, Charles River’s Tailored Portfolio Solutions platform enables wealth and asset management firms to offer high-value portfolio customization at scale. Firms can manage the construction and trading of in-house models, third party separately managed account (SMA) strategies, or operate Direct Index programs tailored to the requirements of each individual investor.

Tailored Portfolio Solutions Capabilities

Charles River’s Tailored Portfolio Solutions enables wealth managers to efficiently deliver highly customized portfolios at scale. Wealth firms can apply client-directed or manager-initiated constraints to a performance benchmark to replicate that index’s performance and risk attributes within the client’s portfolio. TPS enables managers to tailor portfolios through:

Tax Optimization

Managers can minimize the tax burden on portfolios by coordinating tax events across accounts, incorporating held away assets, and factoring in clients’ tax rates and objectives. The solution also helps improve after-tax returns by allowing managers to make optimal tax/risk trade-offs in rebalancing.

ESG Customization

TPS allows for an investor’s environmental- and social-based values to be reflected in the portfolios by capturing and implementing their preferences while still adhering to the benchmark or tracking model. Negative screening can help ensure compliance with ESG criteria.

Direct Index

The risk/return profile of an index can be replicated while adhering to operational constraints such as minimum trade sizes or client requirements like tracking error and position limits. This capability supports custom benchmarks, concentrated positions, and the transition management requirements typically involved with the implementation of complex investment objectives.

Household IPS Implementation

Tailored Portfolio Solutions automates integrated portfolio management and decision making across a household of accounts, avoiding wash sales and managing tax and risk outcomes.

Portfolio Optimization

Optimization technology acts as the engine for Tailored Portfolio Solutions (TPS), allowing clients to build portfolios according to stated objectives and constraints. Employing portfolio optimization provides wealth managers with fit-for-purpose analytics across portfolios and their corresponding benchmarks. The process begins with the capture of data containing objectives and specific constraints for customization. Charles River then leverages its optimization technology to build scale and efficiency into the portfolio implementation process either on a real-time basis or as a batch process.

Powering Portfolio Customization at Scale

Personalized

- Deliver highly customized portfolios for the mass affluent market

- Designed to mitigate tax burdens, reflect ESG convictions, replicate an index, and integrate household accounts

- Provides a value-added offering that can help improve outcomes for clients

Scalable

- Scalable technology allows portfolio customization for large numbers of accounts

- Built as part of Charles River’s Wealth Management Solution, with the configurable and scalable platform to support business growth

Efficient

- Simplifies the operational complexities that were once a barrier to customization at scale

- Optimization technology is the engine that powers Tailored Portfolio Solutions