Enabling Success: Innovation & Partnership

2025 Data SurveyEnabling Success: Innovation & Partnership

2025 Data SurveyOur latest global data survey shows GenAI is having the biggest impact in the front office, with strong productivity gains and more to come.

Key Trends in Wealth: Growth, Efficiency, and Innovation

Wealth ManagementKey Trends in Wealth: Growth, Efficiency, and Innovation

Wealth ManagementKey wealth trends and how Charless River’s flexible platform supports growth across asset classes and jurisdictions.

The Wave: Highlights for OMS/EMS Advances

Order and Execution ManagementThe Wave: Highlights for OMS/EMS Advances

Order and Execution ManagementAs automation evolves, it’s transforming the buyside OMS/EMS space—broadening electronification and enhancing PM-trader communication.

Redefining Institutional Investing with Alpha

Institutional InvestorsRedefining Institutional Investing with Alpha

Institutional InvestorsWith Alpha at the center of your investment operations, firms are empowered to drive growth and uncover new opportunities in every market.

Creating Dynamic Operating Models with Smartsourcing

Operating ModelsCreating Dynamic Operating Models with Smartsourcing

Operating ModelsExperts share their perspectives on what we mean by Smartsourcing and why it is capturing the attention of investment firms today.

That’s Settled: The T+1 Growth Opportunity

T+1 Trade SettlementThat’s Settled: The T+1 Growth Opportunity

T+1 Trade SettlementWe’re well-positioned to support your shift to T+1 by offering a range of advanced services.

Private Credit & Valuations Webinar

Private MarketsPrivate Credit & Valuations Webinar

Private MarketsIs Private Credit poised for continued growth or facing headwinds as default risks rise and regulatory pressures grow?

Operating Model Design in Private Markets Investments

State Street AlphaOperating Model Design in Private Markets Investments

State Street AlphaA discussion on operating model design in Private Markets and insights on how investment firms are transforming to meet stakeholder demands.

Making Preparations Ahead of North America’s Shift to T+1

T+1 Trade SettlementMaking Preparations Ahead of North America’s Shift to T+1

T+1 Trade SettlementThe TRADE speaks to Charles River about client readiness for the shift to T+1 and the value of AI for the buy-side trading desk

State Street Alpha for ETF Issuers

Exchange Traded FundsState Street Alpha for ETF Issuers

Exchange Traded FundsState Street Alpha now supports the entire ETF lifecycle with front, middle and back-office capabilities.

Helping Fixed Income Traders Keep Pace with Rapidly Changing Markets

Order and Execution ManagementHelping Fixed Income Traders Keep Pace with Rapidly Changing Markets

Order and Execution ManagementHow our OEMS platform helps institutional traders meet rapidly changing demands for best execution, trade automation and portfolio trading.

State Street Alpha & Rimes: Enhancing Index and Benchmark Data

Partner EcosystemState Street Alpha & Rimes: Enhancing Index and Benchmark Data

Partner EcosystemOur strategic partnership with Rimes provides institutional investors with a broad range of curated benchmark and index data.

Introducing CRD Academy

Charles River IMSIntroducing CRD Academy

Charles River IMSClients can access virtual instructor-led and self-paced training to gain an in-depth understanding of Charles River IMS tech and services.

State Street Alpha: Next-gen Data Management for Investment Firms

Alpha Data PlatformState Street Alpha: Next-gen Data Management for Investment Firms

Alpha Data PlatformJeff Shortis spoke at TSAM London to discuss how we’re helping investment firms provide their front office with data-driven insights.

Charles River & MSCI: Empowering Investors with Differentiated Multi-Asset Analytics and Data

Partner EcosystemCharles River & MSCI: Empowering Investors with Differentiated Multi-Asset Analytics and Data

Partner EcosystemHow our partnership empowers firms and asset owners with MSCI’s differentiated data and analytics, seamlessly integrated in Charles River.

Alpha & FactSet: Leveraging Differentiated Data & Portfolio Analytics

Partner EcosystemAlpha & FactSet: Leveraging Differentiated Data & Portfolio Analytics

Partner EcosystemPartnering with Factset provides clients with differentiated analytics and data sources across the investment lifecycle.

FundGuard Investment Accounting in Charles River

Partner EcosystemFundGuard Investment Accounting in Charles River

Partner EcosystemWatch how FundGuard and State Street Alpha empower clients with a cloud-native, multi-book fund and investment accounting solution.

Modernizing Data Architecture for Capital Markets

State Street AlphaModernizing Data Architecture for Capital Markets

State Street AlphaThe Alpha Data Platform (ADP), powered by Snowflake, provides a fundamentally new approach to managing growing volumes of investment data.

Evolution of OEMS Strategies & Front-to-Back Platforms

Trading - OEMSEvolution of OEMS Strategies & Front-to-Back Platforms

Trading - OEMSWatch how open architecture, interoperability and front-to-back platforms are reshaping fintech for investment managers and asset owners.

Portfolio Management and Risk Analytics

Charles River IMSPortfolio Management and Risk Analytics

Charles River IMSA complete solution for portfolio construction and optimization, risk forecasting, performance attribution and scenario analysis.

State Street Alpha Data Platform (ADP)

DataState Street Alpha Data Platform (ADP)

DataLearn how the Alpha Data Platform (ADP), powered by Snowflake, helps consolidate and streamline data management.

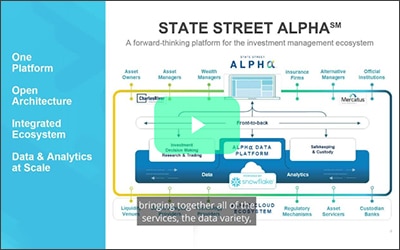

Welcome to State Street Alpha

State Street AlphaWelcome to State Street Alpha

State Street AlphaState Street Alpha can help you streamline and simplify your investment processes – All assets, faster insights, on one platform.

State Street Alpha for Private Markets

State Street AlphaState Street Alpha for Private Markets

State Street AlphaState Street Alpha for Private Markets provides a complete view of the investment lifecycle supported by a solid data management foundation.

State Street Alpha for Post Trade

State Street AlphaState Street Alpha for Post Trade

State Street AlphaState Street Alpha can empower you with the post-trade technology and services that best support your operating model.

State Street Alpha for Institutional Traders

State Street AlphaState Street Alpha for Institutional Traders

State Street AlphaInvestment managers use Alpha to execute trades across asset classes, demonstrate best execution, & make better informed trading decisions.

State Street Alpha for Portfolio Managers

State Street AlphaState Street Alpha for Portfolio Managers

State Street AlphaCollaborate & communicate more effectively with Alpha’s open architecture, choice of third-party, data and analytics.

Our ESG Solution

State Street AlphaOur ESG Solution

State Street AlphaLearn how we help investment firms and asset owners manage ESG focused portfolios.

Charles River IMS on Microsoft Azure

Charles River IMSCharles River IMS on Microsoft Azure

Charles River IMSCharles River IMS in Microsoft Azure helps firms innovate, bring new products to market quickly, and mitigate operational & security risks.

Charles River Tailored Portfolio Solutions

Tailored Portfolio SolutionsCharles River Tailored Portfolio Solutions

Tailored Portfolio SolutionsCharles River’s Tailored Portfolio Solutions enables wealth and asset management firms to offer high-value portfolio customization at scale.

Streamlining Wealth Manager and Sponsor Communications

Charles River Wealth HubStreamlining Wealth Manager and Sponsor Communications

Charles River Wealth HubThe Charles River Wealth Hub is the industry’s first API-driven open network solution, automating and streamlining connectivity.

Want to Learn More? See a Demo? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Looking for Tech Support?

CLICK HERE.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.

Latest Insights

From Control to Confidence: The New Era of Investment Data Strategy

How Data-Driven Decision making is Shaping the Future of Investing

How Digital Transformation is Redefining Client Experience

From Bottlenecks to Breakthroughs: How Digital Transformation Streamlines Investment Operations

Why Digital Leaders are Winning in Investment Management