Kellie Smith in conversation with Barnaby Edmunds, Liana Mackay, Peter Sherriff and Clayton Issitt.

Industry forces are driving investment firms to rethink their approach to operating model design as they strive for diversification, growth and a competitive edge. With the window to transform narrowing, establishing partnerships with providers that operate as an extension of a firm’s business is becoming key.

Recently, Kellie Smith had a discussion with Barnaby Edmunds, Liana Mackay, Peter Sherriff and Clayton Issitt for the latest edition of our Speaking of Alpha series. They spoke about the evolution of smartsourcing, striking an optimal balance between internalized and outsourced capabilities, and how modern technology platforms can help investment firms scale and grow.

Kellie Smith

Marketing Manager, Asia Pacific

Charles River

Peter Sherriff

Director of Product Strategy, Asia Pacific

Charles River

Clayton Issitt

Head of Alpha Client Solutions, Asia Pacific

State Street

Barnaby Edmunds

Director and Principal Consultant,

1886 Consulting

Liana Mackay

Principal Consultant,

1886 Consulting

What’s the difference between traditional outsourcing and smartsourcing? Why is the industry talking about it now?

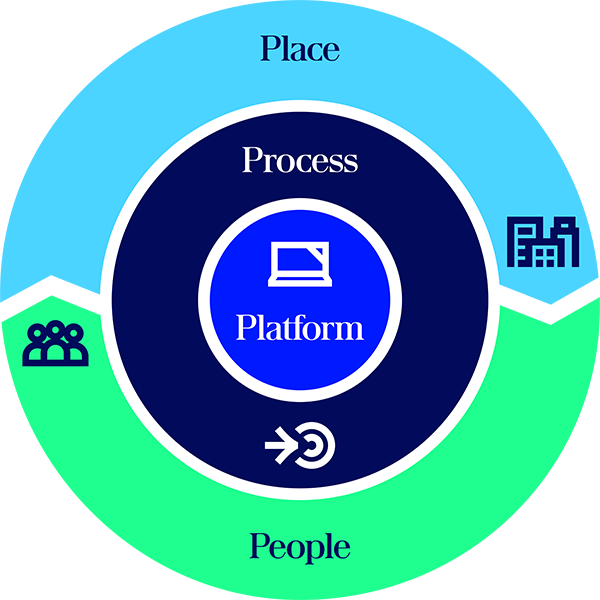

Peter: Smartsourcing offers flexibility and strikes an optimal balance between internalized and outsourced capabilities encompassing all four elements of an operating model, namely process, people, place and platform.

You have your process, the people with the right skill sets, the place, whether it is being done internally or outsourced, and the platform that provides the foundation and enables the model to run. Smartsourcing essentially allows the place to be independent of the other three P’s, so the functional processes remain constant. What changes is who is doing the same thing, in the same way on the same platform.

The ability to have flexibility in the place in which something occurs without affecting the other key pillars of the model, whether insourced, outsourced or hybrid, is key.

Barnaby: The pace of change in the industry is exponential. Clients are becoming more advanced and the window to transform an operating model is shrinking. With smartsourcing, the notion of responsibility versus accountability presents a significant industry shift. Forming partnerships is critical, with providers being an extension of the client’s business.

Outsourcing a particular functional responsibility is not diminishing accountability. Rather, it’s more about providing the client with optionality around their operating landscape. Smartsourcing is changing the dynamic, with the narrative increasingly focused on business outcomes rather than contractual obligations and building the right partnerships while maintaining internal accountability for those capabilities.

An enterprise platform needs to be flexible and should support dynamic operating models to enable clients to overcome new challenges efficiently.

How do you educate clients and prospects about the benefits of smartsourcing?

Liana: We start by describing what smartsourcing is, and the evolution and maturity of the various technology and service providers available.

We consider smartsourcing to be complementary to a client’s operating model, offering flexibility that extends beyond their operating model needs today to accommodate future needs as they arise. This could be a move into new asset classes or markets, acquisitions to provide increased scale and reach, or development of internal skill sets to sustain in-house functions over time. Smartsourcing enables that evolution.

Clayton: Traditionally, when outsourcing the middle office, clients define the functionality, which differs for each organization.

For instance, the creation of an investment book of record (IBOR) involves multiple subcomponents including building positions, applying corporate actions and pricing, reconciling to your other books of record and implementing a quality assurance (QA) process. Service model flexibility means some components can be disconnected and made modular. As an example, having clients manage the QA process allows sovereignty over their data governance process.

This use case enables us to help clients bridge a skill gap while building capabilities or transitioning from lower value operational tasks without having to outsource everything. It is not a one-time “set and forget” model.

Operating Model Key Elements

- People, both employees and outsourcing providers, and their respective skill sets

- Processes those people are tasked with running

- Where those processes take place, whether externally outsourced or internal to the organization

- The technology platform on which those processes are executed

What's driving the industry’s growing interest in smartsourcing?

Barnaby: Broadly, there are four areas driving change in a client’s approach to operating model design.

The first is industry consolidation. The investment giants and megafunds created from mergers and acquisitions rapidly achieve size, without necessarily providing scale. Taking that next step requires changing systems and integrating data, which is time consuming and costly.

Globalization is the second driver. Increasingly, we’re seeing expansion into new markets and areas of focus, which requires partnering with the right provider

to support growth.

Thirdly, diversification of returns by expanding into new asset classes: This requires sourcing new data sets and analytics to support those asset classes.

Lastly, internalization of capabilities: Doing that locally is one thing, while doing that offshore in a new market brings challenges such as market access, trading and regulatory reporting.

These four drivers underscore the need for operating model flexibility, scale and access. Otherwise, it becomes difficult to operate effectively.

Can you describe some of the challenges clients are trying to solve with smartsourcing?

Liana: The pace of change is a constant challenge. It is crucial to consolidate funds quickly and return to business as usual. Smartsourcing helps minimize the impact of consolidation on day-to-day operations.

When we think about globalization and associated regulatory pressures, there’s a lot of jurisdictional nuances. It’s not simply putting a trader on a desk in London and leveraging their market insights and broker relationships; you also need to consider Markets in Financial Instruments Directive (MiFID) reporting capabilities, which adds complexity. That’s where outsourced trading can help.

Clayton: It’s increasingly difficult to find the right people, skills and experience in the right financial centers, compounded by a shift in demographics across the global workforce. Flexibility and capacity to grow around the skills and competencies you have, backed by a trusted partner for things you don’t, with the ability to efficiently dial that up or down as your resources and strategic direction change, is a key reason why this is becoming

a more interesting and robust conversation.

Peter: Firms need to become more solution-focused, rather than technology- or product-focused. This means being able to pull different internal investment capabilities together to create innovative, bespoke and flexible solutions for their clients. It’s difficult for clients to be solution-oriented if they’re distracted by their operating model, and it takes time to upscale or implement a new technology platform to solve for that.

For over 30 years we’ve seen two circular trends. The first is enterprise versus best -of-breed technology, with momentum shifting back and forth over time. The second trend is whether to in source or outsource capabilities. The industry has realized it needs to be more flexible, and it’s not about needing an enterprise platform that connects with an outsourced provider. The emerging alternative is a platform that supports the enterprise and provides flexibility in how to approach the process and the place: Essentially breaking the circle of insource versus outsource and enterprise versus best-of-breed.

“We consider smartsourcing to be complementary to a client’s operating model, offering the flexibility that extends beyond their operating model needs today to accommodate future needs as they arise.”

— Liana Mackay

How do you help clients decide what capabilities to retain and what to outsource?

Barnaby: When helping clients assess their operating model, we address the following key areas. Initially, we look at internal versus external capabilities. What’s optimal is different for each client because they have their own legacy systems, people and internal capabilities.

Traditionally, the first outsourcing barrier to entry was cost, followed by length of commitment and how rigid the services were. Tailoring solutions via smartsourcing has made it more transparent and measurable from a cost and flexibility perspective, removing the need for an “all in” approach.

The next two are interlinked – control required by clients over certain functions and the risks associated with outsourcing. There could be something that’s important to the investment process that firms want to retain such as client or regulatory reporting, or data provisioning. Alternatively, does gaining scale through a smartsourcing provider diminish risk? The conversation has evolved to balance growth and scalability, while managing appetite for control and risk.

How do these considerations transfer into decisions as clients go down that path?

Liana: No two clients are identical, so it’s not a case of doing what everybody else is doing when it comes to smartsourcing. Significant time is spent up front understanding client maturity, their in-house offerings and their competitive differentiators, as this is something you would retain rather than outsource. We then overlay this with their business strategy and where they aspire to be.

Peter: Historically, designing an operating model has involved a cookie-cutter approach, given the trends mentioned earlier. Many firms made independent attempts based on their internal capabilities and the best technology solutions supporting that mix at a point in time. Today, the conversation is more nuanced, with firms seeking specialist advice to design an operating model that has inherent flexibility to support their strategic growth ambitions.

“The investment giants and megafunds created from mergers and acquisitions rapidly achieve size, without necessarily providing scale.”

— Barnaby Edmunds

How has smartsourcing changed the way that these considerations translate into decisions?

Liana: Service and technology providers are constantly evolving, and the maturity of their offerings has come a long way, largely driven by client demand and the need for flexibility. Traditionally, sourcing started with software as a service (SaaS), getting the servers off-site and outsourcing infrastructure management. However, clients require a lot more capability beyond SaaS and that’s where a holistic offering comes into play. For example, services that ensure the right data is delivered via data as a service (DaaS) are gaining momentum.

Clayton: DaaS is a great example of how smartsourcing is changing the game. Historically, the experience of delivering services was limited to a set of deliverables agreed to, including file formats and level of quality, which was then shipped to an SFTP (secure file transfer protocol) location to be collected by the client and quality controlled all over again. Our DaaS capability has evolved to be a shared platform, where the tools we use are visible to our clients. By delivering the capability on an enterprise platform, it radically changes the user experience by blurring the requirement of place.

Clients can choose where in the data lifecycle they want to participate, whether through access to the enrichment process, or simply as consumers, with a robust and transparent governance capability for oversight.

Technology has allowed us to remove the legacy barrier and shift our clients into thinking about higher value activity. More broadly, we have many conversations with clients around inorganic growth. A platform that supports service model flexibility can enable those decisions to be made differently.

Peter: This flexibility is a game changer: From where you place the process, to leveraging your core competency where you have it, and outsourced providers that operate as an extension of your team where you don’t, is having a huge impact.

Ensuring genuine interoperability with other providers is also key. You might have a business unit on the other side of the world with slightly different processes, partnerships or use cases. A platform that’s truly interoperable — more of a genuine plug-and-play ecosystem rather than a bunch of interfaces — is critical to be more solution-oriented for your clients.

What should clients and prospects expect from us and how are we helping clients smartsource their operating model?

Peter: Historically, we’ve seen two types of service providers. First is the rigid black box where you input your requirements and the provider responds with exactly what to expect. The second type is the black balloon that can be shaped how you want, often resulting in a completely unscalable process. We want to provide the right amount of flexibility, and the ability to advise against custom solutions that aren’t extensible or scalable.

For firms to be solution-focused and deliver the increasing scale and complexity demanded by their clients, it’s critical their service providers are also solution-focused. Our solutions are tech centric; this is essential to providing scale and flexibility in the time frames clients require to deliver focused solutions for their investors and beneficiaries.

Clayton: Clients expect local knowledge, global scale and a long-term strategic partnership that leverages best practices and ongoing investment to provide flexible, innovative solutions. We know one size doesn’t fit all: Our clients expect us to meet them where they are in their operating model evolution and to help them continue to deliver against their growth ambitions.

What other services should providers think about offering clients?

Barnaby: It’s an evolution. If we consider the themes we discussed earlier – globalization, internalization, diversification and consolidation – service provider approaches to solution orientation, balancing interoperability and service model flexibility are important conversations to have when solving for any of these. Ultimately, clients are looking for partners that can provide flexibility.

We need to change the narrative to focus on partnerships rather than outsourcing. DaaS is certainly a big theme, driven by areas such as access to private markets, to support what might have been a traditional public market or service provider solution that goes hand in hand with modern tech.

We’ve talked about the need for technology to support not only the data, but the solutions to be interoperable. Generally, this isn’t an investment firm’s area of expertise and it is no longer viable to build operations teams to support these platforms.

Service provider resiliency is also key, and with the continuing transition to cloud-based solutions, it is an area of increased scrutiny by regulators around the world. Firms need to ask: What’s the ease of access locally? How is 24-hour support set up? Is there local support in each region that can assist, not only for services but also for core capabilities? Portfolio analytics and trading, collateral management, regulatory reporting, FX overlays, access to liquidity and scale in those areas are key for service providers.

“We consider smartsourcing to be complementary to a client’s operating model, offering the flexibility that extends beyond their operating model needs today to accommodate future needs as they arise.”

— Liana Mackay

Operating Model Key Elements

- People, both employees and outsourcing providers, and their respective skill sets

- Processes those people are tasked with running

- Where those processes take place, whether externally outsourced or internal to the organization

- The technology platform on which those processes are executed

“The investment giants and megafunds created from mergers and acquisitions rapidly achieve size, without necessarily providing scale.”

— Barnaby Edmunds

6647199.1.1.GBL.

The material presented is for informational purposes only. The views expressed in this material are the views of the author, and are subject to change based on market and other conditions and factors, moreover, they do not necessarily represent the official views of Charles River Development and/or State Street Corporation and its affiliates.