Forward-Looking Insights and Workflows

What is the current valuation of our assets? What would happen to our portfolio if interest rates rise in one region and oil prices plunge in another? These are everyday questions that private market investors face and yet many cannot answer them in less than one week’s time.

With Charles River for Private Markets, investors can connect their Excel spreadsheets and run valuations at scale. They can create custom scenario analyses across funds and assets, allowing them to provide timely insights for their customers. Our patented ModelSync technology enables a seamless valuation workflow process using bespoke models. The solution helps portfolio managers aggregate financials and produce simple, interactive dashboards and other visual insights.

Trust Your Data, Gain Better Insights

Charles River for Private Markets consolidates and normalizes investment data into a single platform. Break through your data silos and connect your technology point solutions to unlock access to faster insights and improved response times to LP queries.

Current Challenges

-

Disconnected business process and systems with different methodologies

-

Lack of transparency and consistency of internal valuation process

-

Deal and Asset management teams continue to rely on Excel / emails with no meaningful ways to mitigate audit risk

-

Inefficient data aggregation and reporting process

Solutions

-

A centralized platform that allows ingestion of valuation datasets by sectors at scale

-

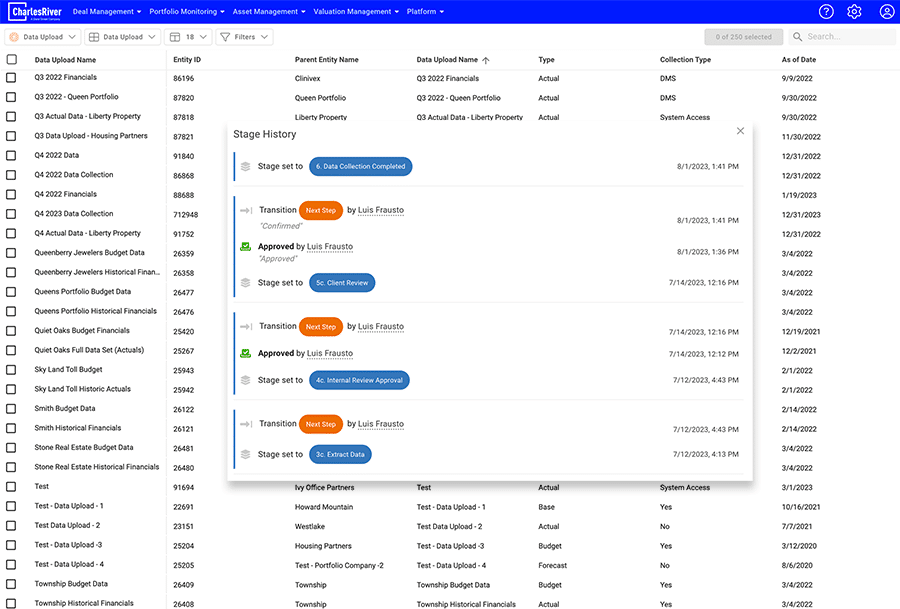

Ability to manage valuation process workflows from assets to fund level with transparency

-

A dynamic database to store and update global assumptions

-

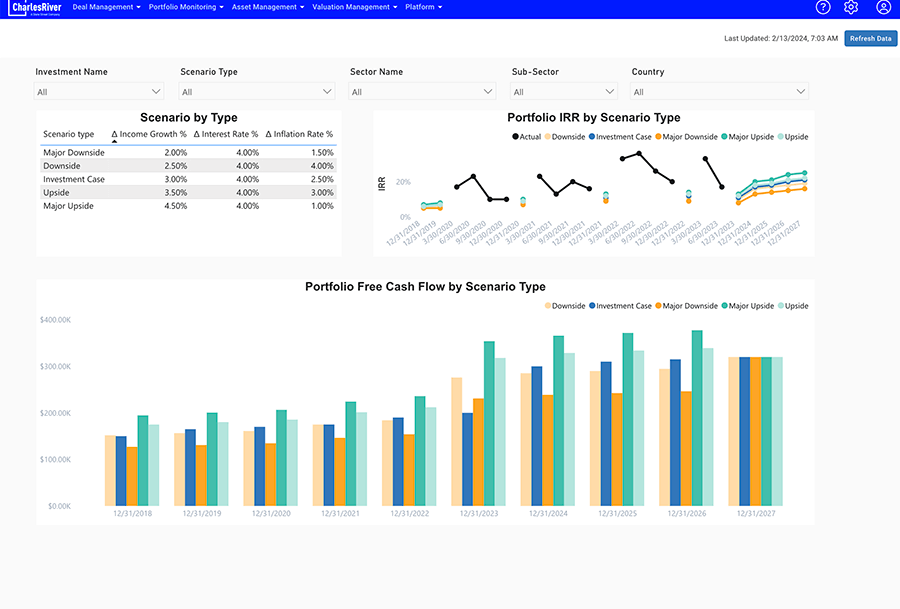

Dashboard capability to visualize portfolio valuation updates and scenario results in real-time

-

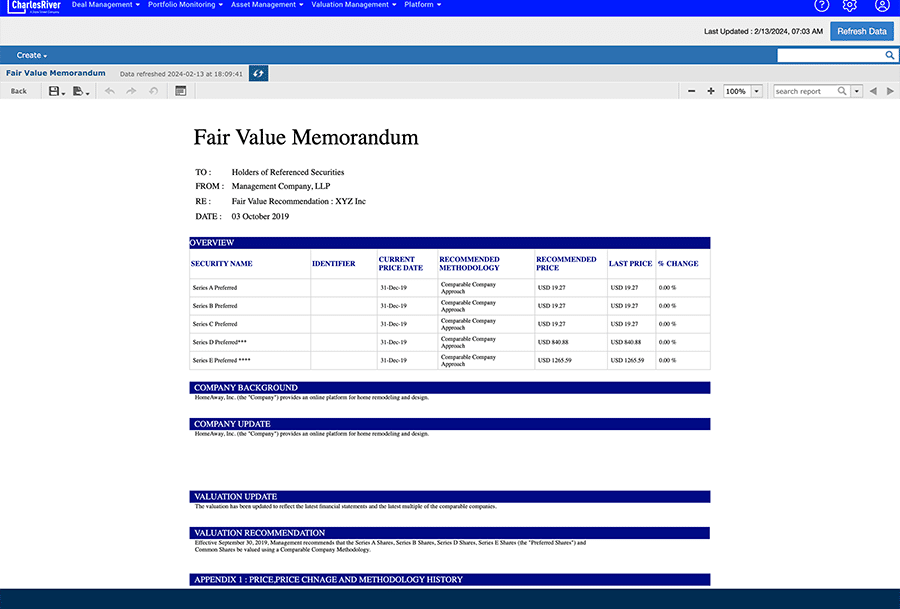

Automated Valuation Reports by investment, Fund, SPV, Portfolio, etc.

Key Capabilities

How our Valuation and Scenario Management framework helps solve private market data management challenges.

Institutionalize valuation oversight & transparency to ensure the right controls, approvals, transparency and auditability occur for every valuation.

Run dynamic event-based valuation & scenario analysis in a single platform to manage risk & make faster investment decisions.

Produce automated valuation reports by investment which shows selected valuation track records.

Want to learn more? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.

Request a Demo to Learn More

Want to learn more? Get in touch.

We're ready to answer your questions. Contact Sales & Marketing by filling out this form.

Follow us on our social channels to stay up-to-date on all Charles River News and Events.